Excerpts from Chan Kim & Renée Mauborgne’s Blue Ocean Strategy (2015) and Blue Ocean Shift (2017) and their How to Achieve Resilient Growth Throughout the Business Cycles Harvard Business Review (March 2020) article.

How to select the ‘right’ strategic initiatives to keep your organization thriving today while at the same time preparing for future profitable growth? This is one of the key questions executives around the world are asking themselves when it comes to the planning and driving of strategic initiatives. Under normal circumstances, predicting and planning future growth and profit is difficult. And in the current uncertain economic situation, it’s even more challenging.

The question is how to build growth and resilience, irrespective of business cycles or economic uncertainty. Which strategic initiatives to pursue and how to select them?

In this article, we’ll discuss how to assess your current business portfolio through the blue ocean lens and help you identify which strategic initiatives to focus on and pursue. We’ll introduce you to a blue ocean tool to help you analyze and manage your corporate portfolio.

Are your strategic initiatives market-competing or market-creating?

Despite these challenging times, companies need to develop their growth strategies. A corporation’s value reflects not only today’s performance but also its future profitability. It hinges upon the performance, growth momentum and profit prospects of all business divisions, rather than upon any single unit. Which strategic initiatives your organization focuses on today will have a direct impact on your future profitability. Are you mostly focusing on managing strategic initiatives that bring revenues today? Or are you a forward-looking executive who identifies the strategic initiatives that will ensure future profitable growth?

What brings future profits and growth to a corporation and how should a corporation plan and balance its business portfolio for both the present and future across its different divisions?

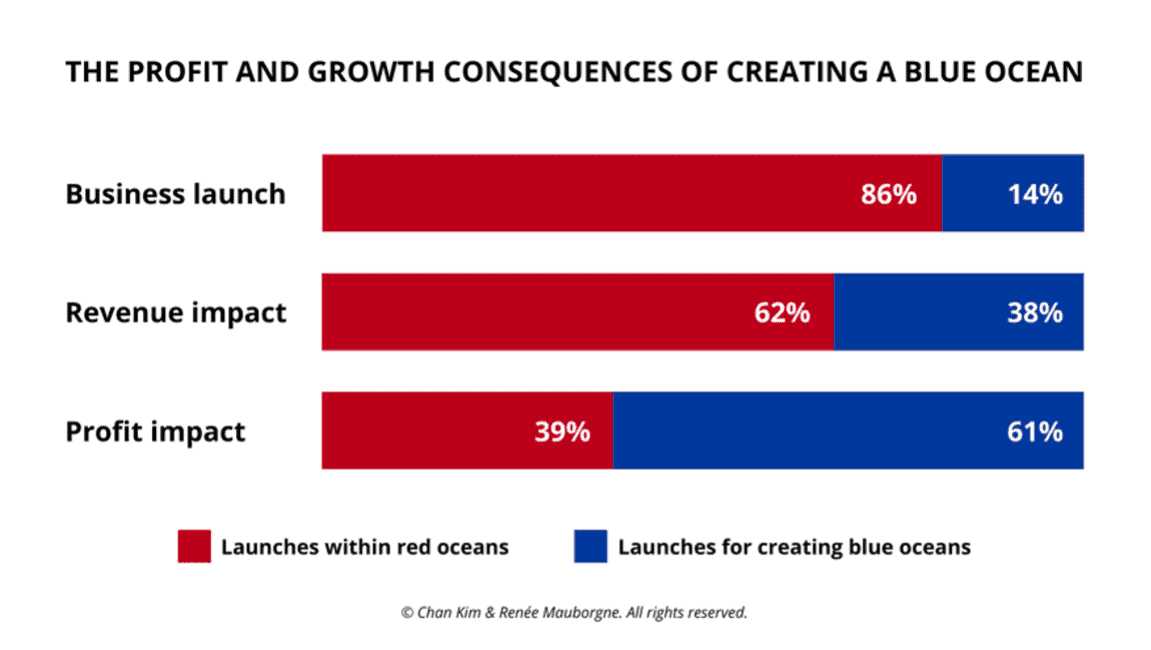

In studying more than 100 new business launches, Chan Kim and Renée Mauborgne found that 86 percent of what companies classified as new business launches were effectively market-competing (red ocean) moves. That is, incremental improvements in existing market space, like a pasta company introducing a new line of gluten-free pasta. This 86 percent of market-competing moves, however, generated only 62 percent of combined launch revenues and 39 percent of profits. By contrast, the remaining 14 percent of launches – those that created markets or recreated existing ones – generated 38 percent of revenues and a whopping 61 percent of profits. In other words, blue oceans offer the real potential for future profitable growth.

The challenge for all companies is how to continue investing in existing revenue-generating businesses while at the same time creating and launching the businesses of tomorrow.

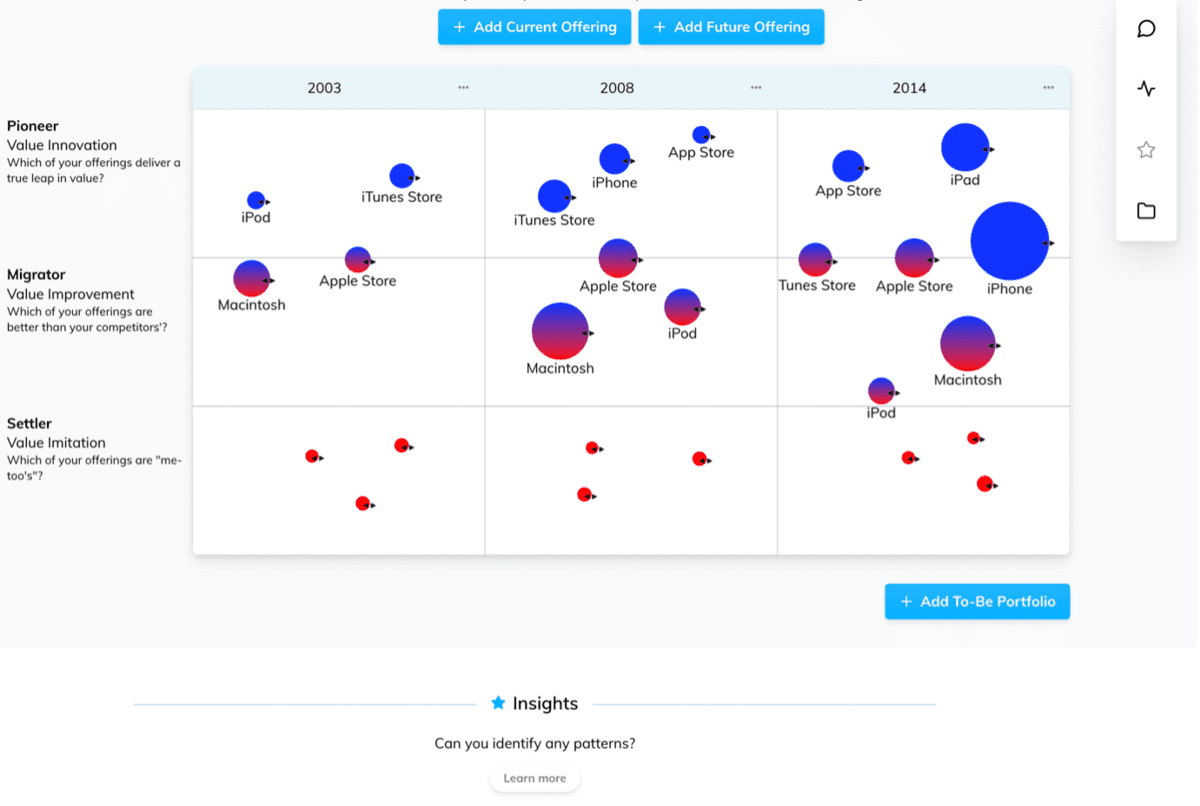

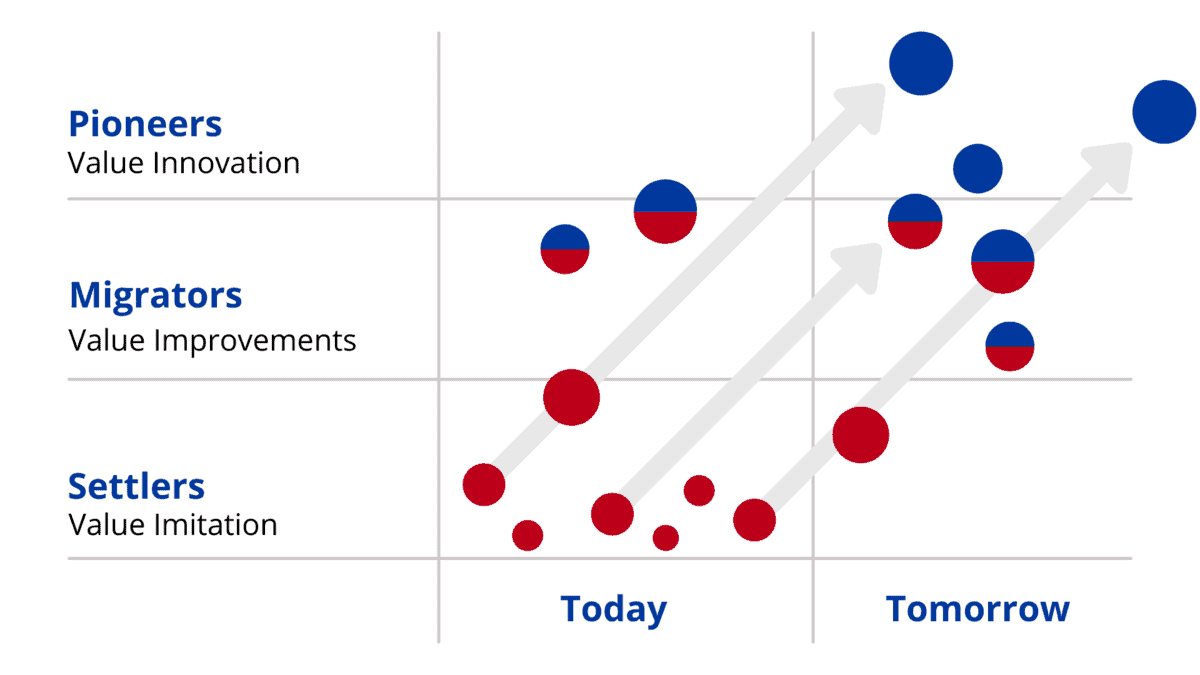

Chan Kim and Renée Mauborgne developed an analytic tool – the Pioneer-Migrator-Settler Map – to address precisely that challenge and, its beauty is that it can be applied dynamically over time to shift the trajectory of a company’s profitable growth prospects.

Using Pioneer-Migrator-Settler Map for corporate portfolio management

Visualizing strategy can help managers responsible for corporate strategy predict and plan the company’s future growth and profit.

The Pioneer-Migrator-Settler Map allows you to see in one simple picture what your current portfolio of businesses says about your future growth prospects and indicates how you should drive your company to lift your prospects over time.

© Chan Kim & Renee Mauborgne. Blue Ocean Strategy. Blue Ocean Shift. All rights reserved.

Settlers are defined as me-too businesses, migrators are business offerings better than most in the marketplace, and a company’s pioneers are the businesses that offer unprecedented value. These are a company’s blue ocean strategic moves and are the most powerful sources of profitable growth. They are the only ones with a mass following of customers.

The Pioneer-Migrator-Settler Map tool guides you to target the area where you have the most to gain by the blue ocean journey and helps you select the right scope for your blue ocean strategic initiative.

The key, for any successful organization, is to maintain a balanced portfolio of pioneers, migrators and settlers—or, put another way, of red and blue oceans, even as once pioneers get imitated.

Having a resilient business portfolio of both market-competing and market-creating strategic initiatives will shield you in volatile times and prepare for future growth.

The example of Apple’s strategic initiatives that opened up a blue ocean

Consider the strategic initiatives in the example of Apple, as shown below. In 1997, Apple could boast just one migrator (the Macintosh) and a handful of settler peripherals and services. And the company’s future hung in question. The Map shows a very different picture in 2003, with the addition of two pioneers (iPod and iTunes), and the Macintosh now lifted to high migrator status with Apple’s launch in 1998 of the iMac—the first colorful, friendly desktop computer that made it easy to connect to the internet. As shown on the Map, by 2008, as the iPod was eventually imitated and sank toward the migrator category, the company reached out and launched its next blue oceans, the iPhone and App store. Then as the iPhone and iTunes store fall into the migrator category, the company introduces the iPad. In other words, Apple has maximized growth prospects by maintaining a healthy balance of pioneers, migrators, and settlers over time, even as the businesses that fell into each category shifted with competition.

©Chan Kim & Renee Mauborgne. Blue Ocean Strategy. Blue Ocean Shift. All rights reserved.

As the dynamic Pioneer-Migrator-Settler Map also makes clear, Apple is not only about blue oceans; nor should any company’s corporate portfolio be. Companies with a diverse portfolio of businesses, such as Apple, General Electric, Johnson & Johnson, or Procter & Gamble, will always need to swim in both red and blue oceans and succeed in both oceans at the corporate level. Once Apple’s iPod began to be imitated, for example, to counter competition it rapidly launched a range of iPod variants at various price points with the iPod mini, shuffle, nano, touch, and so on. This not only served to keep encroaching competitors at arm’s length, but also expanded the size of the ocean it created, allowing Apple, not imitators, to capture the lion’s share of the profit and growth of this new market space. By the time the iPod’s blue ocean became crowded with more imitators, Apple had created another blue ocean by introducing the iPhone.

As pioneers eventually become migrators and settlers, the challenge ahead for Apple is to continue to renew its portfolio so that it can maintain a healthy balance of strategic initiatives between the profit of today and the growth of tomorrow.

To learn more about how Apple’s strategic initiatives opened up a blue ocean, get the case How Apple’s Corporate Strategy Drove High Growth. It discusses in depth how to manage a business portfolio at the corporate level while balancing blue ocean and red ocean strategic initiatives.

How to analyze your current business portfolio using the Pioneer-Migrator-Settler Map

It’s time to draw your business portfolio on the Pioneer-Migrator-Settler Map. You can easily map your current business portfolio and visually see where your organization stands in terms of prospects for future growth. You can invite your team to work with you on selecting the strategic initiatives to focus on.

Follow the steps below to draw your Pioneer-Migrator-Settler Map:

1. Identify the key businesses or product/service offerings in your portfolio

Bring along the people who will be participating in the process.

2. Identify which offerings are pioneers, migrators, and settlers

The goal is to arrive at a reading of where each business or product/service offering stands in terms of value and innovation and not in terms of market share or industry attractiveness. Each offering should be assessed from the point of view of buyers, not in terms of your organization’s other offerings.

3. Plot your portfolio

The aim is to capture each offering’s current position on the map

Detailed step-by-step guidance on how to plot your corporate portfolio together with your team can be found in the book Blue Ocean Shift.

Which strategic initiatives predict your future growth

As an executive or a manager in charge of spearheading corporate strategy, ask yourself the following questions:

1. Where does your current or planned portfolio of businesses on the Pioneer-Migrator-Settler Map fall?

2. Is your portfolio settler-heavy—as is the case with a majority of declining companies?

3. Has a business that was in the past a pioneer, generating huge profit and growth, become a settler, suggesting that the company’s growth is likely to be slow without the introduction of a new pioneer?

4. Or is your portfolio well–balanced, ensuring current cash flow and strong upside profitable growth potential?

What does the map of your corporate portfolio of strategic initiatives show?

If both of your current business portfolio and the planned offerings consist mainly of settlers, the company has a low growth trajectory, is largely confined to red oceans, and needs to push for value innovation. Although the company might be profitable today as its settlers are still making money, it may well have fallen into the trap of competitive benchmarking, imitation, and intense price competition.

If current and planned offerings consist of a lot of migrators, reasonable growth can be expected. But the company is not exploiting its potential for growth, and it risks being marginalized by a company that value-innovates. The more an industry is populated by settlers, the greater is the opportunity to value-innovate and create a blue ocean of new market space.

Red ocean and blue ocean strategic initiatives are not a binary choice. You need both. But while you’re already focusing on market-competing strategies, ask yourself how much of your focus is going to market-creating moves that generate resilient growth.

If you’re an executive what you should be doing is getting your organization to shift the balance of your future portfolio toward pioneers. That is the path to profitable growth.

Forward-thinking executives understand that the real business they are in is not cosmetics or foods or chemicals or computers. It is the business of creating. Only sustained creation will sustain compelling profitable growth. The question is: How much of your organization’s time and talent is lined up behind building pioneers versus managing settlers?

Start taking action today to create a more balanced portfolio of strategic initiatives in your organization. Identify which settlers in your portfolio have the potential to be migrators or pioneers and set your company on the path to profitable future growth.