Excerpts from Chan Kim & Renée Mauborgne’s Beyond Disruption: Innovate and Achieve Growth without Displacing Industries, Companies, or Jobs (Harvard Business Review Press, 2023)

Consider these examples: Netflix versus Blockbuster, Amazon versus booksellers and Main Street retailers, and Uber versus taxis.

They come from different industries, but they have three key factors in common:

First, they’re all cases of disruptive creation.

Second, they all reflect a clear win-lose situation.

And third, they all impose painful adjustment costs on society.

On the positive side, consumers win big-time. That’s why people gravitate to disruptive offerings, be it Netflix, Amazon, or Uber.

For a product or a service to disrupt, it must deliver a leap in value (typically underscored by a new business model); or the industry wouldn’t be thrown into disarray, and purchasers, whether they be businesses or consumers, would see no reason to shift from the incumbent offering to the new one.

But growth here is achieved in a win-lose way. The disrupter’s success comes at the direct expense of existing players and markets.

Which brings us to the second commonality: Disruptive creation imposes a clear trade-off between winners and losers. In some cases one wins and everyone else loses. That’s because the leap in consumer surplus provided by the disrupter can nearly wipe out the existing industry and its incumbent players.

Although the disrupter is hailed as a winner in the press, and purchasers and investors flock to it, this win-lose approach triggers the third commonality: painful adjustment costs for society, often hidden by the euphoria and glamour that surround disruption.

Take Amazon. It didn’t merely displace Borders’ 1,200 stores and countless independent booksellers and take a huge chunk out of Barnes & Noble’s sales. It is doing the same to Main Street retailers and department stores nationwide.

As Amazon wins big-time with strong growth, most of these other players have been losing big-time with an alarming rate of store and mall closings and bankruptcies across America. The human costs of Amazon’s disruption include tens to hundreds of thousands of lost jobs, not to mention the visual effect of forlorn, boarded-up stores, which subtly wears on people’s psyches and tarnishes the vibrancy of a community.

Retail jobs may not be glamorous, but they provide livelihoods for millions of people.

Chan Kim & Renée Mauborgne, authors of Beyond Disruption

Towards a positive-sum approach

In contrast to disruption stands nondisruptive creation – creation without disruption. While disruption occurs within an existing market, leading to a high level of displacement, nondisruptive creation is generated when you create a brand-new market outside or beyond the boundaries of existing industries where there are no established market or players to disrupt and fail.

By disentangling market creation and market disruption, nondisruptive creation allows organizations to grow with little to no social pain imposed.

You can think of it as a positive-sum approach to innovation—as opposed to the win-lose nature of disruptive creation—a much-needed complement to disruption as a pathway to growth.

Take the nondisruptive creation of Kickstarter. It created a brand-new funding opportunity for all creative works most of which are not envisioned to earn an ROI.

Prior to Kickstarter most creative works never got realized as few creatives have access to funding, which prohibits them from realizing their artistic vision. So it should come as no surprise that Kickstarter’s online crowdfunding platform did not displace or take away even a tiny share of existing equity investors’ or venture capitalists’ profit, growth, or investment opportunities and didn’t eat into the existing finance industry.

And because backers receive no monetary incentives on Kickstarter—only cool merch or other recognition such as a shout-out on the creative’s website—a new set of investors emerged: people who care about creative work and helping others realize their dreams.

While creatives won, so did Kickstarter. Within three years of its launch it became profitable and in its first decade Kickstarter raised a staggering $4.3 billion for projects supported on its platform, successfully funding more than 160,000 ideas that by all accounts would have gone unrealized otherwise.

Yet, no one lost a job because of Kickstarter, and no company went out of business because of it. It helped the artistic community flourish without unleashing hurt or painful adjustment costs on society. It’s pretty much a win all around.

The Economic and Social Impact of Nondisruptive Creation

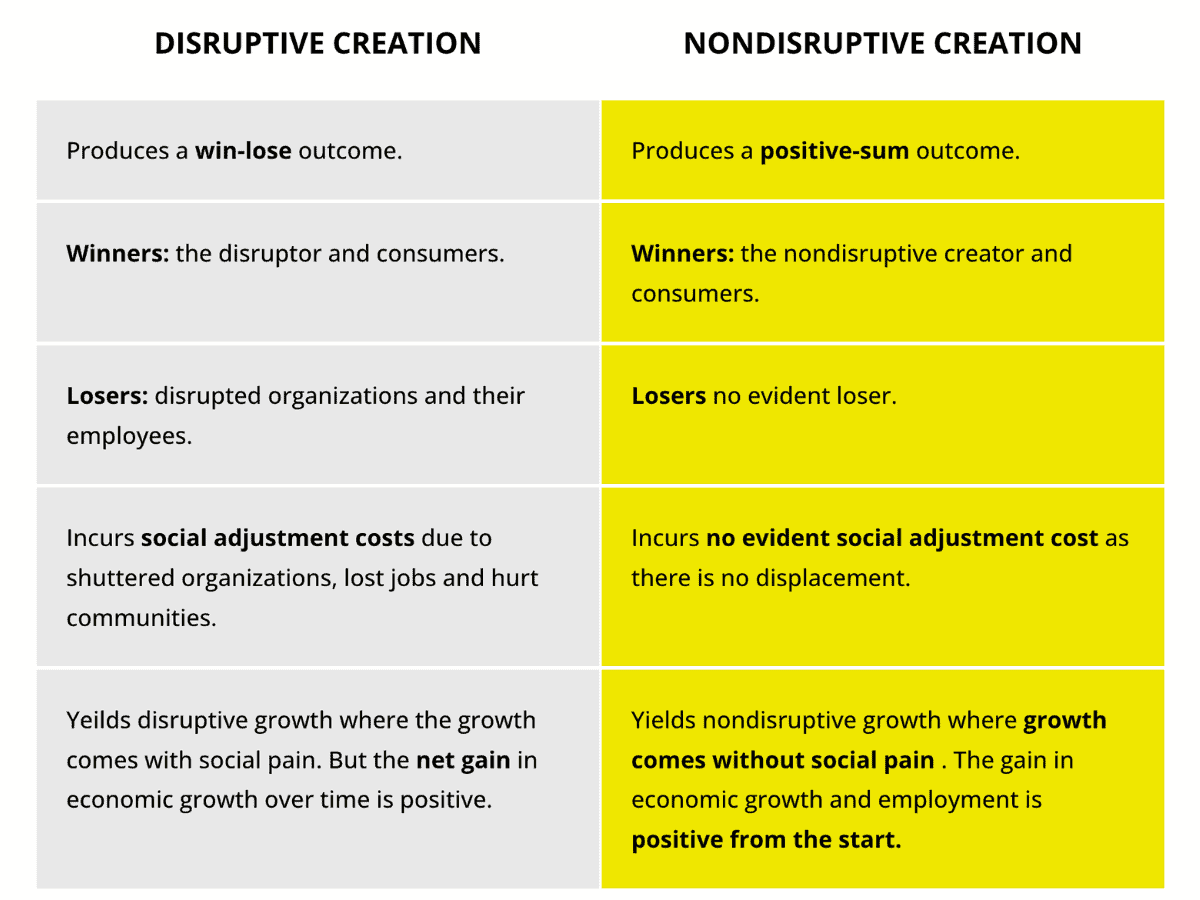

The table summarizes the economic and social impact of nondisruptive creation.

The question is, if disruption dominates your thinking, what nondisruptive opportunities might you be missing?

We invite you to read Beyond Disruption, where we explore why nondisruptive creation should matter to you, whether you’re an incumbent or a startup, how it complements disruption and how you can identify and execute on nondisruptive opportunities to more thoughtfully pursue your growth and innovation strategies in a way that better balances business and society.