Written by J. Rae Cho & Tim Polkowski, Value Innovation Group

Medical Tourism in Thailand

Medical tourism, a combination of tourism and medical treatment, has become its own industry and grown rapidly thanks to the blue ocean approach taken by a couple of healthcare players and savvy governments. As a result, Thailand has succeeded in positioning itself as a top destination for medical tourism. It became a #1 medical tourism destination by volume of care in 2014 and attracted over 2.4 million foreign patients in 2017, while Thai hospitals such as Bumrungrad International hospital and Bangkok hospitals have emerged as industry leaders with impressive growth and profits.

Bumrungrad Hospital Medical Tourism

Bumrungrad International Hospital, for example, has grown to become the largest private hospital in Southeast Asia with revenues of over US$540 million and a net margin of over 20%, the highest among Thai private hospitals.

Bumrungrad International Hospital, Bangkok, Thailand

Medical Tourism in Thailand: How did Thailand create its blue ocean?

To create this blue ocean in medical tourism Thai hospitals and policymakers depended on two crucial insights;

1. To create huge market opportunities they had to look beyond existing demand from healthcare customers to the noncustomers of the healthcare industry, and;

2. To convert noncustomers into new customers they had to address pain points that were preventing people from choosing Thailand as a healthcare destination.

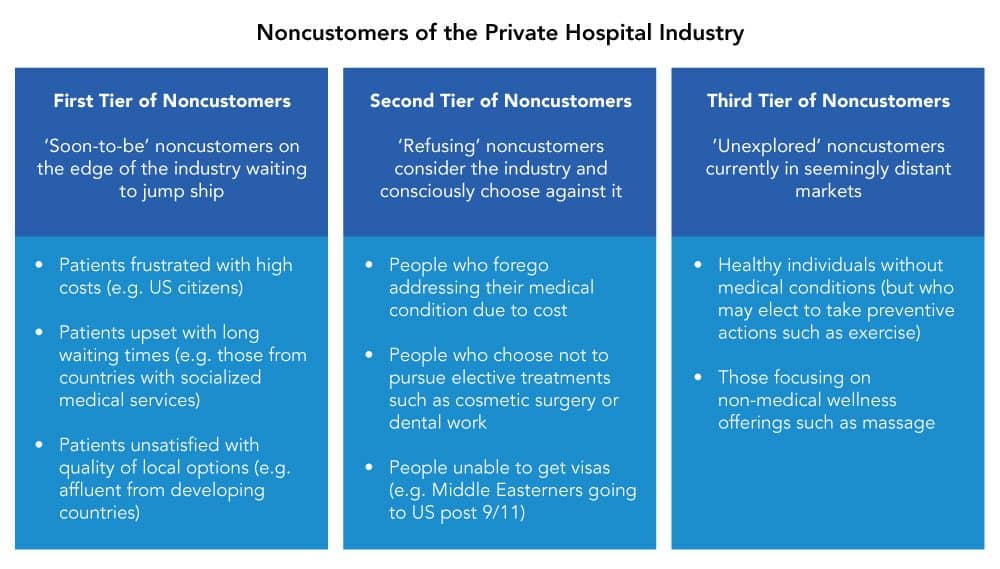

Identifying new demand – the Three Tiers of Noncustomers

They recognized that demand for private medical services in the domestic market was limited but also realized there is huge unmet demand for affordable, quality medical services globally.

Many people in advanced countries struggled to find affordable medical care, such as in the United States where there are 40 million people who cannot afford to receive necessary treatment. On the other hand, affluent citizens from less developed countries could afford to pay for services but high-quality medical services were not readily available locally.

Using Chan Kim & Renee Mauborgne’s Three Tiers of Noncustomers, we can identify the major categories that make up the ocean of noncustomers to the private hospital industry that could be tapped to unlock new demand.

The three tiers use successively wider lenses to view the ocean of noncustomers that could be tapped to unlock new demand. Once the new demand has been identified, the next question was how to convince these people to come to Thailand for medical services. Why are they noncustomers? What pain points were stopping them from being part of the industry?

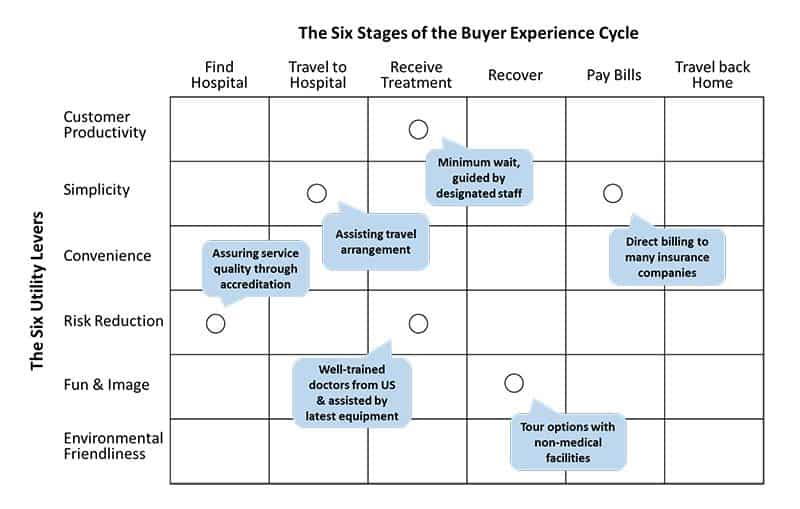

Converting noncustomers into customers – Buyer Utility Map

For many people, the thought of travelling to Thailand for medical care was beyond their imagination. Medical services may be cheap in Thailand, but could the quality be trusted? How would somebody even go about figuring out all the details for accommodations, meals, transport, etc. that are not part of the medical procedure? These were major concerns and pain points of noncustomers, and only by addressing them in a holistic and systematic manner, a mass of medical tourists could be attracted to the country to receive care.

To see how these pain points were addressed to deliver exceptional utility that converted noncustomers to customers in Thailand, we can use Chan Kim & Renee Mauborgne’s Buyer Utility Map. The map outlines the stages of the typical noncustomer’s, or buyer’s, experience (the horizontal axis on top) and the levers that can be pulled to deliver exceptional utility to buyers (the vertical axis on the left).

The figure below is the depiction of Buyer Utility Map for Bumrungrad International Hospital.

Bumrungrad International Hospital’s Buyer Utility Map

To be recognized as a high-quality medical institution to attract foreign patients, Bumrungrad hospital focused its resources on getting internationally recognized accreditation which was successfully obtained in 2002 from the US-based Joint Commission International. It was the first hospital in Asia to achieve this distinction.

To further mitigate perceived risks associated with foreign hospitals, Bumrungrad hospital brought in Thai nationals who had studied and practiced medicine in the US in addition to setting up 40 referral offices worldwide where potential patients could visit and get detailed information on their treatment plans.

At the hospital, guides who speak the patient’s language, accompany them throughout their visit, directing them to doctors’ offices, tests, and dispensaries as necessary, so that they do not lose time or get lost. Waiting times are kept to a minimum, and results of tests are quickly obtained. Diagnoses and treatment procedures are therefore quickly determined, and the patients spared long periods of anxious waiting for results.

Beyond assuring the quality and efficiency of medical services, the hospital offers end-to-end services that include travel arrangements, visa extension services, airport transfer, interpreting, shopping, and tourism activities to ensure their clients have a smooth and enjoyable experience.

Lastly, Bumrungrad hospital has agreements with many insurance companies in other countries and provides direct billing or reimbursed billing services to patients. This has drastically simplified the payment process of medical treatment and ensured transparency in their bills.

What happened when Bumrungrad International Hospital addressed all these pain points? It created demand and attracted new customers – a lot of them. The hospital now serves over 520,000 foreign patients annually.

The medical tourism industry turning red with competition

Thailand made a blue ocean shift in the medical tourism industry to its great benefit, but such a lucrative and growing market has attracted the interest of governments and healthcare providers across the globe. The once blue waters are turning increasingly bloody with competition. While Thailand is well positioned in the industry to continue to profit for years to come, its ability to drive growth and profitability will become increasingly difficult as more and more competitors enter the market.

For companies and policymakers alike, this then begs the question – where’s the next blue ocean of growth and profitability? That’s the (multi) billion-dollar question.

Medical tourism in Thailand is a blue ocean.

A different ocean of noncustomers waiting to be served – the next blue ocean industry?

What can we learn from Thailand’s blue ocean move in medical tourism? Can the same logic and lessons be applied to other industries and groups of noncustomers? We think so.

It can be done for one of the fastest-growing groups of people in the world, many of whom have multiple unmet needs and have the willingness and means to pay for a solution – retirees and the elderly.

Populations in countries across the globe are ageing quickly, and as policymakers and businessmen have recognized the world over, new solutions are needed to cater to their needs. Like the private medical industry, imagine how many noncustomers there are of the existing retirement industry.

How many are frustrated with the cost or level of service of local retirement services? How many cannot afford services or decide to forego retirement altogether to work for a modest wage? The number of noncustomers of the private medical industry was huge, but the number of noncustomers of the retirement industry is even bigger.

And while there are increasing numbers of retirees going abroad for retirement, the majority have not yet made that leap as they have multiple concerns preventing them from trying out new retirement services. Just like medical tourists, there are multiple pain points that must be addressed before they are converted from noncustomers to customers.

But the opportunity is not going unnoticed. That may be why Boon Vasin, a Thai businessman, is investing US$500 million to establish a 5-acre ‘medical city’ for retirees on the outskirts of Bangkok. Or why Japanese companies have started exporting their elderly care model to Thailand.

The international retirement industry is relatively limited as of today but is poised to become a booming industry in the years to come. Rather than a question of when it is more of a question of who will figure out how to unlock the ocean of demand represented by noncustomers. Who will convert the noncustomers to paying customers by uncovering and addressing their hidden pain point? As with medical tourism, the tools are there, and we will soon see businesses and policymakers that make a blue ocean shift to grow and profit from this new multi-billion-dollar industry.

By J. Rae Cho & Tim Polkowski, Value Innovation Group

About the authors

Value Innovation Group (VIG) is a team of global blue ocean experts with vast experience in assisting organizations to shift from red oceans of cutthroat competition to blue oceans of new market space for rapid and profitable growth. VIG is a member of Blue Ocean Global Network, an international community of blue ocean practitioners.